16 year-old Camilla Savelieva chronicles the collapse of FTX

16 June 2021. Sam Bankman-Fried in an interview during the Bitcoin 2021 conference.

May 9, 2024

The meteoric rise and fall of FTX and its founder Sam Bankman-Fried

Former ‘crypto king’ Sam Bankman-Fried (commonly known as SBF), was sentenced to 25 years in prison on March 28, at the end of one of the biggest financial fraud cases in US history.

FTX, a cryptocurrency exchange, was founded by SBF in 2019. Controlled by an ‘inner circle of close associates’, the Bahamas-based company quickly became a leader in the crypto sphere.

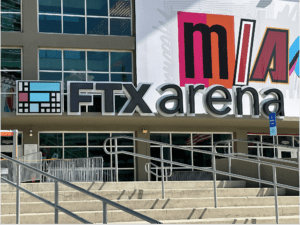

Costly publicity campaigns drew more people into FTX and the crypto sphere, with the company – and its idiosyncratic owner – gaining worldwide fame and hitting a $32bn valuation in early 2022. Less than a year later, that trajectory came to an explosive end. SBF’s empire collapsed around him, leaving crypto’s ‘golden boy’ bankrupt and under investigation.

An environment built on chaos, complacency and mismanagement resulted in massive losses for customers and criminal repercussions. FTX is now cited as one of the biggest examples of a cryptocurrency trade failing. Its demise sent shockwaves across the crypto market.

Cesare Fracassi, professor of finance at the McCombs School of Business at the University of Texas, Austin

“FTX was a big collapse. No-one really expected it,” Cesare Fracassi, professor of finance at the McCombs School of Business at the University of Texas, Austin, told Harbingers’ Magazine.

It was SBF’s image that led to FTX’s meteoric rise and its downfall. “SBF was on the cover of magazines, he was the new whizz,” Professor Fracassi said.

“He was articulate, he understood traditional finance and crypto, he was extremely popular and extremely knowledgeable. He had an aura that people believed him, but it turned out he was not as good as we thought he was.”

How did it all go so wrong so quickly? We explain the rise and fall of SBF and his empire.

The rollercoaster of trust in crypto

SBF’s first step into the world of cryptocurrency was via Alameda Research, a crypto trading firm he co-founded in California in 2017. Eighteen months later, he set up FTX, which eventually became the third-largest crypto exchange with more than a million users. The relationship between the two companies is key to this story.

Previously seen as something niche, the crypto sphere saw more and more people pour in after Bitcoin hit its expansive growth in 2021. Professor Fracassi put this down to a “genuine understanding” that decentralised finance (known as defi) and crypto technology was “going to be used more and more in the future”.

People became fascinated by this reportedly revolutionary technology that heralded a financial revolution – it rejected centralised finance systems and also provided dazzling returns for investors. This ecosystem ballooned, burgeoning with new start-ups, coins and buyers.

But the volatility of the market soon became apparent. Referred to by Professor Fracassi as “the winter of defi and crypto,” 2022 was the year in which many of these new crypto start-ups went bust, which led to distrust of the crypto ecosystem and because of this decline in prices some lending companies went bankrupt.

Learn more:

By CoinGeek

Cryptocurrency was created to eliminate the middle-man of banks, governments and other centralised finance agencies, but in the minds of many people it has now become synonymous with the words ‘Ponzi’ and ‘rug-pull’.

In fact, SBF himself likened the structure of cryptocurrency exchanges to that of Ponzi schemes, stating that cryptocurrency tokens mainly derive their value from the way market participants perceive them.

The relationship between FTX and Alameda

The collapse of FTX was prompted by an article by CoinDesk reporter Ian Allison on November 2, 2022. Allison revealed the close ties between FTX and Alameda’s finances, and the precarious place this put both businesses in.

Allison explained that much of the funds in Alameda consisted of FTT – FTX’s own token that was essentially “printed out of thin air”. Out of Alameda’s total assets of $14.6bn, $3.66bn were ‘unlocked’ FTT (tokens that could be sold and traded). Also, FTX customer money was used to pay Alameda’s debts.

Allison’s article and a series of well-timed tweets brought the viability of FTX into question and ultimately to its knees, following panic by investors and customers. A few days later, as the exchange was trying to handle a surge in withdrawals ($6bn was withdrawn by customers in just 72 hours), FTX’s problems suddenly became very apparent.

The involvement of Binance, another crypto trading platform, which had been one of FTX’s first investors, was also crucial. After the revelations of Allison’s article, Binance tweeted publicly that it was liquidating its remaining FTX stake (in FTT), causing panic among other FTX investors.

As part of Binance’s exit from FTX equity last year, Binance received roughly $2.1 billion USD equivalent in cash (BUSD and FTT). Due to recent revelations that have came to light, we have decided to liquidate any remaining FTT on our books. 1/4

— CZ 🔶 BNB (@cz_binance) November 6, 2022

FTX, struggling, had to come back to Binance, begging for a buyout from the company to stay afloat. Binance initially agreed, but after undertaking “corporate due diligence,” decided to pull out, driving investor panic and the run on FTX that led to the discovery of an $8bn hole in its finances.

On November 11, FTX and Alameda Research filed for bankruptcy. A month later, SBF was arrested in the Bahamas and extradited to the US, where he was charged with seven counts of fraud and money laundering.

Misuse of customer funds

One of the main charges against SBF was the misuse of customer funds, with FTX making massive loans to Alameda in order to finance risky trades.

Alameda’s FTX account details

Liquidating = False

Negative balance limit = $65 billion— db (@tier10k) January 17, 2023

This was not only in violation of FTX’s own terms of service but also US securities law. The indictment claimed that FTX customer funds were also used to make massive political donations (mainly to the Democratic party and other left-leaning organisations), violating campaign finance laws, and also to buy real estate in the Bahamas, and invest in start-ups.

Whether or not SBF knew about FTX’s illegal activities was a main point of contention during his trial and a key part of the lawsuit filed against him by the Commodity Futures Trading Commission (CFTC). While his company collapsed around him, SBF repeatedly claimed that he did not know what was going on within his company, nor what had happened to the funds.

In an interview with the BBC in 2022, when asked whether he was fraudulent or incompetent, SBF stated his innocence, saying: “I did not knowingly commit fraud. I don’t think I committed fraud, I didn’t want any of this to happen, I was certainly not nearly as competent as I thought I was.”

SBF pleaded not guilty to the charges, maintaining his innocence in a mass of media interviews and during the trial itself. But in November last year, the jury found him guilty of lying to investors and lenders and stealing billions of dollars from FTX.

Prosecutors called for a prison sentence of 40–50 years, while SBF’s lawyers argued that their client should serve six and a half years. In March, 18 months after the collapse of FTX, SBF was sentenced to 25 years in prison, with his lawyers promising repayments to victims.

The faces behind the finance

Scandals like FTX can be seen through an analytical lens. Examining graphs, balance sheets and computer code can provide invaluable insight into the inner workings of a company, but so too do the people involved – their weaknesses, fears and objectives.

For SBF, the ‘celebrity genius’, his downfall seemed to be understanding relationships. According to author and finance journalist Michael Lewis – whose 2023 book about SBF, Going Infinite: The Rise and Fall of a New Tycoon, topped the bestseller lists – he “saw his life in numbers” and turned “everything into a game”.

His on-again-off-again relationship with ex-girlfriend Caroline Ellison, CEO of Alameda Research, whom he met at a Wall Street trading firm in 2015, represents not only SBF’s nature but also the complicated links between FTX and Alameda and the problems in their working relationship.

Ellison often lamented about her relationships, including her relationship with SBF, on her presumed (since deleted) “worldoptimization” public Tumblr blog.

In her testimony against SBF, as quoted in The Independent, she said she “wanted more” from the relationship and “felt he was distant or not paying attention” to her. And in his book Going Infinite, Lewis describes office memos from Ellison begging SBF to acknowledge their relationship publicly and SBF giving an almost comically scientific list of reasons why he could not do so, irrespective of Ellison’s feelings for him and his supposed feelings for her.

Loss of trust and regulatory failings

Despite SBF’s reputation for new-fangled financial wizardry, his crimes were “accounting fraud of a boringly age-old kind,” according to Ari Juels, professor at the Jacobs Technion-Cornell Institute at Cornell Tech and the Technion, and co-director of the Initiative for Cryptocurrencies and Contracts.

He said: “The fraud at FTX wasn’t a technology issue and there was little about it that related fundamentally to the technical specifics of cryptocurrency. The asset happened to be cryptocurrency, but essentially the same kind of fraud is possible with and has been perpetrated with other assets.”

The collapse of FTX destroyed trust, which the cryptocurrency sphere is built on.

Professor Fracassi commented how “there was a big hit on trust. Many people had their tokens in FTX […] when they went under, many customers lost all their money. People have been a lot more sceptical since the FTX collapse, not so much about crypto but sceptical about unregulated entities.”

Professor Fracassi attributes the failure of FTX not only to SBF himself but also to the regulatory frameworks: “People didn’t really understand exactly how to regulate this large crypto conglomerate. The EU, US, the standard international regulatory bodies have been trying to create a framework so that something like FTX won’t happen again, but it’s still a work in progress.”

The prevalence of fraud in the cryptocurrency ecosystem is down to two reasons: anonymity and its largely unregulated status, according to Professor Fracassi “you don’t have to give an identity to anyone, so it’s a lot easier to hide behind a wall of anonymity”.

As for general financial advice, the professor emphasised the importance of investing in a diversified portfolio while also understanding some of the risks concerning the volatility of the crypto market. “If you are a young person, I think you should at least know what crypto is and how it works because there is some chance that this new ecosystem people are building is going to be used a lot,” he told Harbingers’.

But he advises caution: “Don’t fall prey to all these ‘get rich quick’ schemes, whether in crypto or not. They are also not good for self-esteem and building something useful and being a productive member of society. Focus more on getting rich inside yourself.”